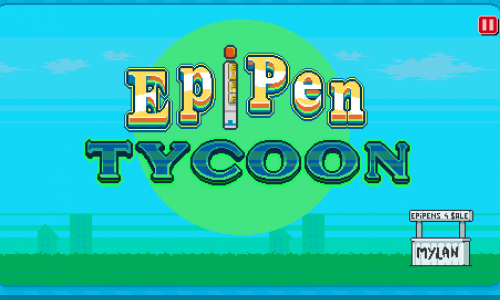

There’s an EpiPen Tycoon computer game.

In it, you are the CEO of Mylan, Heather Bresch, the daughter of a US senator who has been handed a drug that lays a golden egg — EpiPen, an emergency anaphylaxis treatment that stops people’s throats from closing in the event of an allergic reaction.

It’s mostly for children.

In real life, Bresch infamously jacked up the price of the drug from around $100 in 2007 to where it now sits, at $608. This caused has caused a public outcry.

In the game, you, the player, must balance making your shareholders happy — apparently they love if when you increase the price of the drug — and making sure you’re not tarred and feathered on Twitter.

Aside from being able to control the price of an EpiPen, you can also call your dad for a favor. You can introduce a generic at just the right moment. Sad things can happen too, though. For example, you may have to sell a vacation home if the price of the EpiPen gets too low and your shareholders are mad.

All the while, there is a bar that swings from left to right as you swing from enraging your money-hungry shareholders or the public. All the while, your salary is constantly changing as you toggle the price.

It’s a pretty fun game, actually. But what’s more interesting about it (for nerds like myself) is what it says about what our stock market has become.

Let’s think about this for a second. The romantic notion of the American stock market is dead. The stock market is not an investment club of doctors in central Pennsylvania spitballing ideas about Coca-Cola. It’s not aunties in Wisconsin watching CNBC and listening to Jim Cramer either.

The stock market is barely even a place where companies raise money anymore. Mostly it has become a place where companies return money to shareholders.

Bloomberg’s Matt Levine touched on this a while ago:

“In 2014 those companies’ combined earnings were about $950 billion, dividends were about $350 billion, and buybacks were about $553 billion. So total cash handed back to shareholders was about 95 percent of profits, up from 88 percent in 2013 and 72 percent in 2010.”

That trend hasn’t changed. Companies are still returning money to shareholders — or “renters,” as the Roosevelt Institute refers to them — at a rapid clip.

“In other words, the financial system is no longer an instrument for getting money into productive businesses, but has instead become an instrument for getting money out of them,” the Roosevelt Institute’s researchers write. “The sector overall is now predicated largely on seeking rents through payouts rather than increasing profits through growth.”

And so who are these lucky renters/shareholders?

Well, the top shareholders in Mylan (aside from Abbott Labs, part of which Mylan acquired last year) are a bunch of mutual funds/asset managers — like Wellington Management Group, BlackRock, Vanguard, T. Rowe Price, and State Street — and some hedge funds, like John Paulson’s Paulson & Co. and David Einhorn’s Greenlight Capital.

In the game, these investors get ANGRY when the price of Mylan goes down — after all, it’s pretty much all Mylan’s got. If Mylan’s margins are thin, that means less cash is returned to shareholders. They don’t care how it’s done.

And in the game, when that happens, the shareholders call for Bresch’s head. One way to lose is to get ousted by the board when the investors get good and angry.

Here’s the thing, though — most of these investors aren’t going to do diddly squat to Bresch.

Most of these stock market dinosaurs are sleepy. Every now and then, an activist investor, like a Bill Ackman or Carl Icahn, will get involved with the stock and try to wake them into some kind of action. Every now and then, a third party like Institutional Shareholders Services will recommend this or that change.

But for the most part, the mutual funds are just passive — but powerful — waves, flowing through the stock market.

And they are investing for America’s retirement. This is the structure we’ve chosen.

Not that you would know that the people investing for your last decades are in Mylan, though; most Americans don’t even know what’s in their 401(k)s. We aren’t shareholders anymore. We’re not investors. We’re clients — dumb ones.

Of course, this isn’t just our fault. There are other ways to look at what companies should be doing other than the one it seems we have in place — the one where the only player in the game who matters is the shareholder.

Until about the 1970s, companies took Harvard Law professor Merrick Dodd’s approach to the function of a corporation.

“The business corporation,” Dodd said in a 1932 issue of the Harvard Law Review, is “an economic institution which has a social service as well as a profit-making function.”

In the 1970s, that flipped.

Noted economist Milton Friedman wrote in The New York Times Magazine in 1970 that a corporation’s only “social responsibility of business … [is] to increase its profits” for shareholders who “own” the corporation.

We’ve lent credence to that idea by making our retirements depend on shareholders’ returns. It’s not working either. Investing isn’t making the cut, as Sens. Claire McCaskill (D-Missouri) and Susan Collins (R-Maine) pointed out in a press release on Friday morning.

“As of 2015, the difference between what people have saved and what they will need to live in retirement was a staggering $7.7 trillion. This serious gap is concerning workers across our country, 82 percent of whom say their generation will have a much harder time achieving financial security compared to their parents’ generation.”

The little we have put away, obviously, is precious. In turning a blind eye to how companies have made profits to return to us, we’ve let them know we don’t care how they do it. We don’t care if they’re harming society anymore.

The only way to let companies know that isn’t the case is to sell a company’s stock when they’re doing so. We have to do it over and over again.

We have a crisis on our hands either way. We don’t need to make it any worse.